- HOME

- ECO PACKAGING

- PAPER PACKAGING

-

SOLUTIONS

-

ECO Packaging Solutions

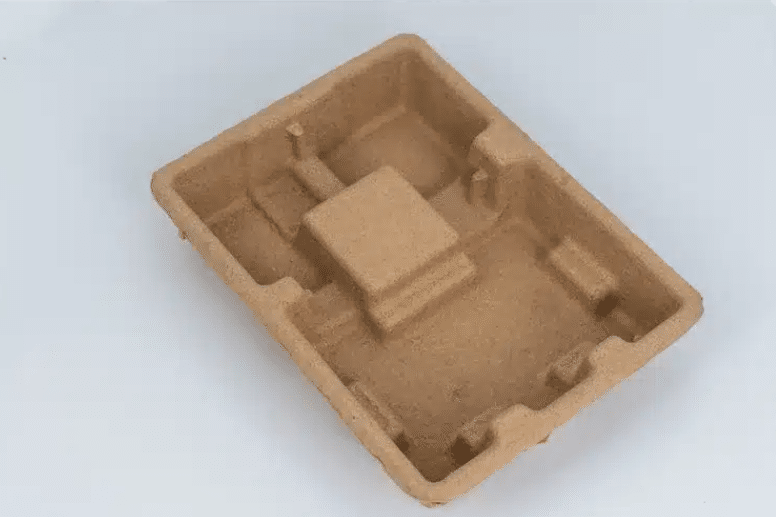

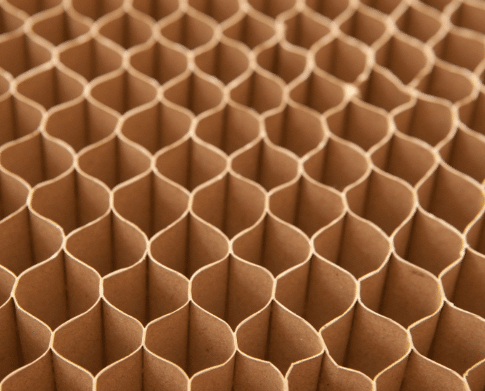

Perfume Pulp Packaging Cosmetics Pulp Packaging Jewelry Pulp Packaging Food Pulp Packaging Electronics Pulp Packaging Festival Pulp Packaging

-

Popular Packaging Solutions

Perfume Packaging Cosmetics Packaging Jewelry Packaging Food Packaging Watch Packaging Supplement Packaging Electronics Packaging Christmas Packaging Valentine Packaging Halloween Packaging

-

- Custom

- ABOUT

- SUSTAINABILITY

- RESOURCES

- CONTACT

- HOME

- ECO PACKAGING

- PAPER PACKAGING

-

SOLUTIONS

-

ECO Packaging Solutions

Perfume Pulp Packaging Cosmetics Pulp Packaging Jewelry Pulp Packaging Food Pulp Packaging Electronics Pulp Packaging Festival Pulp Packaging

-

Popular Packaging Solutions

Perfume Packaging Cosmetics Packaging Jewelry Packaging Food Packaging Watch Packaging Supplement Packaging Electronics Packaging Christmas Packaging Valentine Packaging Halloween Packaing

-

- RESOURCES

- ABOUT

- CUSTOM

- CONTACT US

- SUSTAINABILITY